Once the conflict process is completed, any kind of modifications to your credit scores reports could bring about modifications in your credit report. Whether your score rises, down or continues to be the same relies on what you're contesting and also the end result of the disagreement (credit report dispute equifax). Elimination of erroneously reported unfavorable details, such as late repayments or unsettled collections accounts, might lead to credit scores score enhancements.

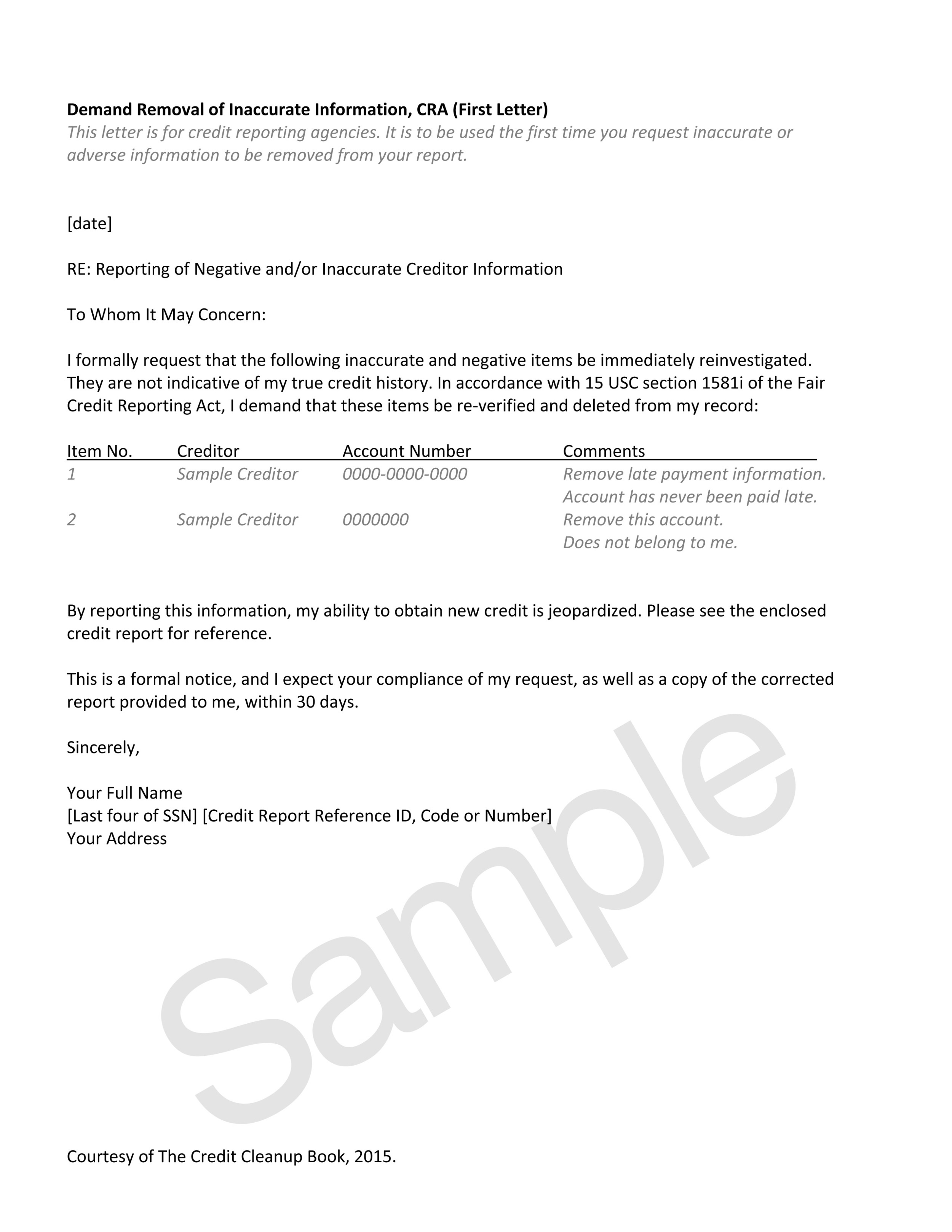

What to Do if You Differ With the Result of Your Disagreement If you do not concur with the outcomes of your disagreement, here are some extra steps you can take: Your ideal next step is to speak to the entity that originally gave the disputed information to Experian and offer proof their info is inaccurate.

Call info for every resource appears on your credit report, and you can utilize it to connect to them. A statement of conflict allows you describe why you believe the details in your credit scores record is incomplete or unreliable. Your declaration will appear on your Experian credit scores record whenever it's accessed or asked for by a prospective lender or creditor, so they might ask you for more details or documents as part of their evaluation or application process.

The 5-Second Trick For Credit Report Dispute Form - Gecu

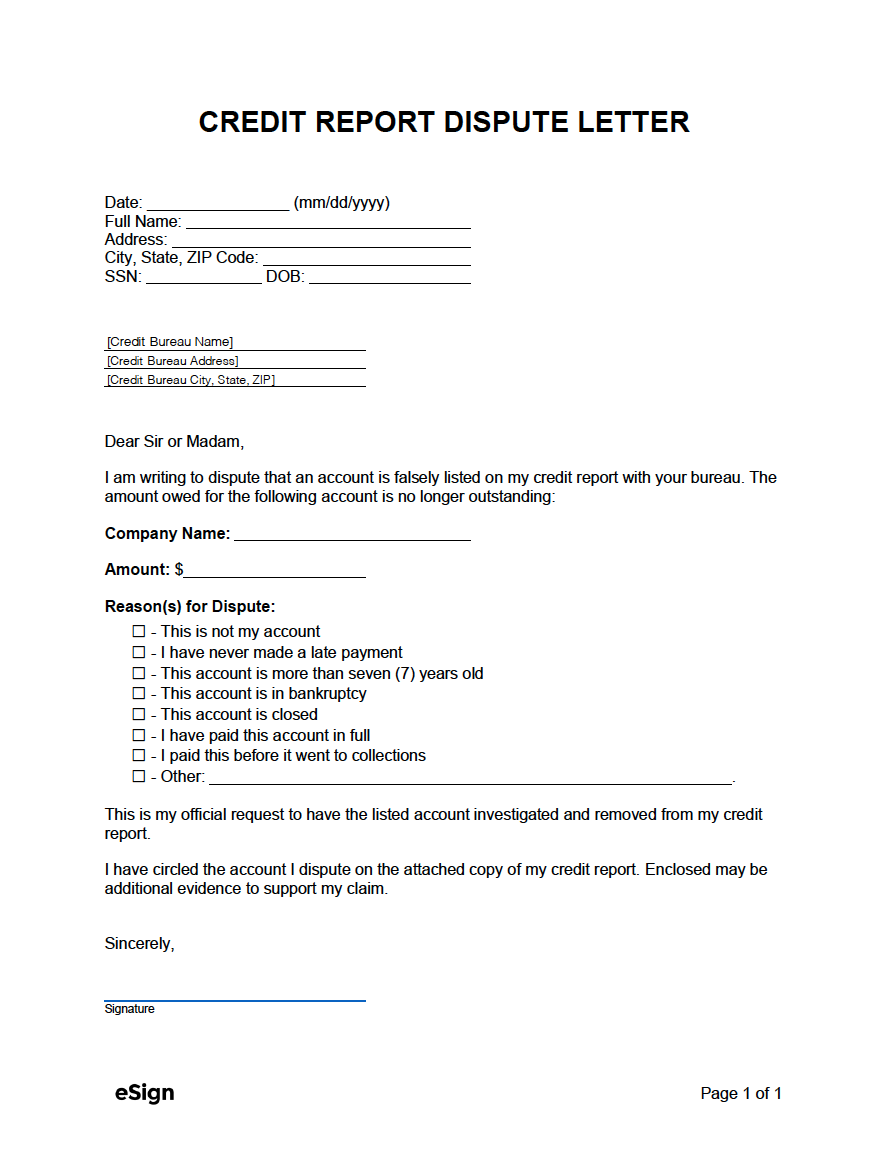

A dispute with additional relevant info can additionally be submitted by mail to Experian at P.O.

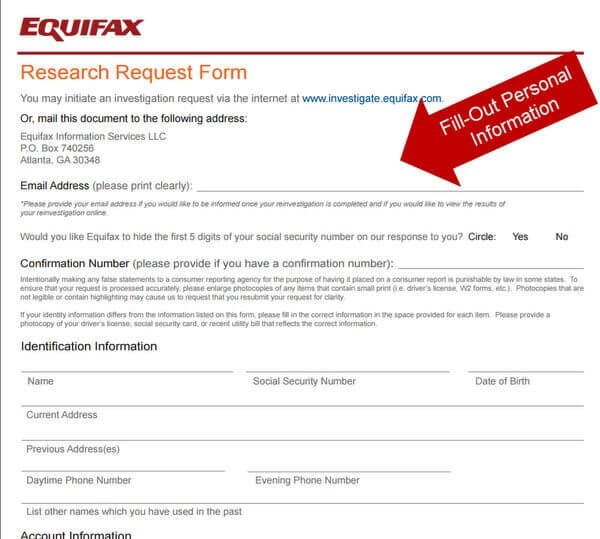

Equifax, Trans, Union and Experian and also big three huge 3 reporting credit report announced Tuesday revealed they're going to continue allowing consumers permitting receive free weekly complimentary regular for one more year until April 20, 2022. The information comes right after bothering headlines showing that customers are discouraged with just how their debt is being managed by those extremely exact same companies.

websiteOur What To Do If Your Credit Dispute Is Denied - Credit Reporting ... PDFs

Then in an issue of days, his score unexpectedly rolled by 91 points in May. He apparently really did not do anything wrong to drive that score back listed below 600. He simply was caught in a COVID-19-related problem connected to some trainee financings. Some mistakes located on credit rating reports can be associated to financial institutions messing up the coverage of a selection of payment lodgings, consumers misinterpreting the exact adjustments supplied and also the credit reporting firms themselves making blunders."As quickly as the pandemic hit, a big number of lending institutions began identifying that their car loan profiles would certainly be going into default which isn't great for anyone," stated Ian Lyngklip, a lawyer at Lyngklip & Associates Customer Law Facility in Oak Park."A great deal of conflicts are happening due to the fact that customers don't recognize exactly the nature of what is being done," Lyngklip stated.

"When you have a great deal of tailored work being done, you have a high likelihood of mistakes falling in," Lyngklip said. Several times, he stated, customers would call asking for a way to stay clear of making repayments for a month or two on an expense.

"Did the financial institution forgo repayments? Deal a deferment? These are the correct concerns to ask a lending institution, he said, regarding what is being supplied by way of car loan holiday accommodation.